Wilmington, DE – Embattled crypto exchange FTX received a pivotal nod from the U.S. court, granting it permission to liquidate its vast cryptocurrency assets. This move, FTX claims, aims to repay its customers in U.S. dollars, safeguarding them from the unpredictable whims of crypto market fluctuations.

A Proactive Step Towards Repayment

U.S. Bankruptcy Judge John Dorsey endorsed FTX’s strategy during a court session held in Wilmington, Delaware. With this approval, FTX is greenlit to offload up to $100 million of its cryptocurrency weekly. Additionally, the court granted the exchange the leeway to delve into both hedging and staking ventures. These strategies are expected to shield FTX from the notorious price volatility inherent in the crypto sector while simultaneously generating passive earnings from established cryptocurrencies such as Bitcoin and Ether.

Addressing Potential Market Impact

FTX’s proactive approach to liquidating assets is not without concerns. The exchange voiced apprehensions about potentially influencing market dynamics due to their significant holdings. To combat this, FTX has strategically partnered with U.S.-based crypto juggernaut, Galaxy, leveraging their expertise to curb the risks associated with “information leakage” potentially resulting in sharp price downturns.

However, refraining from action carries its own perils, with FTX potentially trapped in depreciating assets, as outlined in their court documents. To maintain flexibility, Judge Dorsey provisionally permitted FTX to elevate its liquidation pace to $200 million per week, contingent upon unanimous agreement from both creditor committees.

FTX’s Crypto Portfolio Breakdown

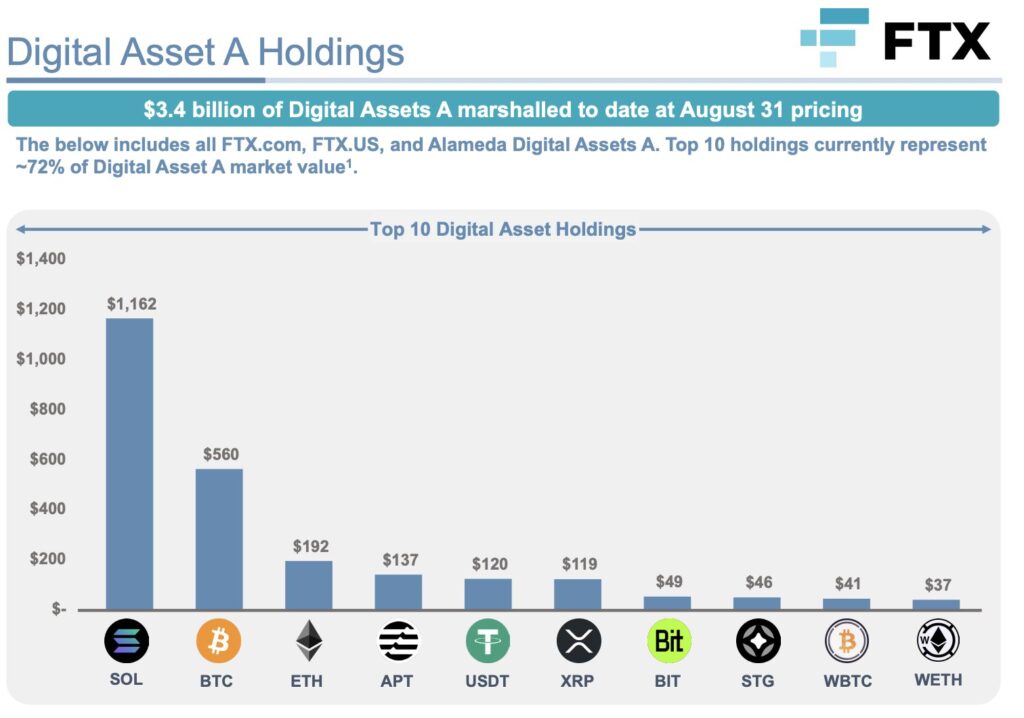

A recent revelation from FTX unveiled a whopping $3.4 billion in crypto assets, notably including $1.16 billion in Solana, $560 million in Bitcoin, and $192 million in Ether.

The journey to this juncture started with FTX’s bankruptcy filing in November 2022, stemming from allegations of misappropriating billions in customer crypto deposits. Nevertheless, FTX boasts of recuperating over $7 billion in assets for customer reimbursement. In tandem, the company is vigorously pursuing further recoveries via litigations targeting internal FTX members and other beneficiaries pre-bankruptcy.

FTX’s luminary, Sam Bankman-Fried, maintains his innocence against accusations of deceitfully leveraging customer funds for his speculative ventures. Some of his former colleagues at FTX, however, have conceded to criminal charges.

Unified Goal: Swift Repayment

FTX’s proposed course of action found support during the court hearing, particularly from a representative of the FTX customer committee. Meanwhile, an advocate for the unsecured creditors committee echoed the sentiment, emphasizing the urgency of the repayment process. As he aptly put it, “The sooner we can get this process rolling, the better.”

In their August filing, FTX made a compelling case for the liquidation, detailing the benefits of hedging and staking their crypto assets for the welfare of all stakeholders.

One lingering concern broached during the session revolved around asset traceability. An FTX representative clarified that these digital assets are considered the debtor’s property. However, another attorney highlighted the blended nature of these assets, making individual customer traceability a challenge.

Rounding off their future-centric initiatives, FTX has expressed interest in bringing Galaxy Digital’s Mike Novogratz onboard as an advisor, fortifying their strategy with his renowned expertise.