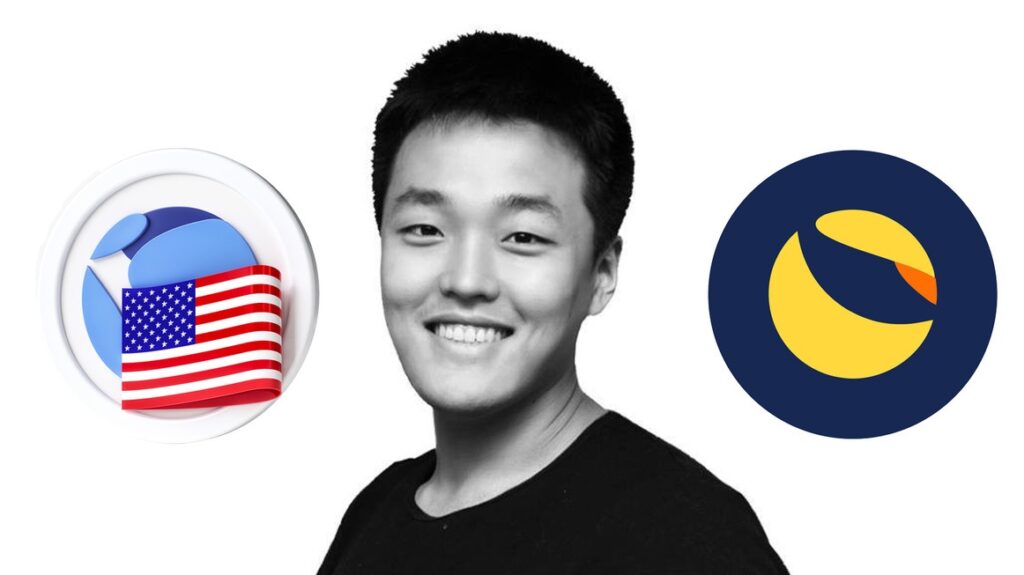

In May 2022, the cryptocurrency ecosystem trembled as Do Kwon’s terraUSD stablecoin (UST) collapsed, leading to accusations of misleading investors and instigating a dreaded crypto winter. The aftermath saw Terraform Labs and Kwon entangled in a lawsuit filed by the U.S. Securities and Exchange Commission (SEC).

Unearthing Jump Trading’s Role

Recent court documents reveal a potential turning point in the case: the role of market maker Jump Trading. It’s alleged that Jump Trading amassed $1.28 billion in profits during the UST crisis, casting a spotlight on their involvement and activities.

In a 2021 incident, UST temporarily diverged from its dollar peg. Kwon attributed the stability maintenance to its automated algorithm. However, the SEC contends that Jump Trading’s market intervention at Terraform’s request was the real savior.

Kwon’s defense, outlined in a letter to the Singapore Supreme Court, counters the SEC’s claims. They insist Jump Trading’s UST trades didn’t restore the peg in May 2021, marking a crucial disagreement in the unfolding legal drama.

Unpacking the May 2022 Depreciation

Kwon’s team argues that third-party shorting led to UST’s May 2022 depeg. In financial parlance, shorting involves betting against an asset, aiming to profit from its decline – a strategy drawing scrutiny amidst the stablecoin’s tumble.

Kwon, now in a Montenegro jail following an arrest for possessing false ID documents, faces an intensified legal battle. His defense underscores a nuanced argument: the SEC lacks jurisdiction, asserting that the assets in question are currencies, not securities.

This jurisdictional contention isn’t unique to Kwon’s case. It resonates in ongoing legal dialogues involving crypto giants like Binance and Coinbase, marking a broader regulatory conversation in the fast-evolving digital asset landscape.

Navigating the Intricacies of the Case

The lawsuit against Kwon and Terraform Labs isn’t just a legal altercation; it’s a narrative interwoven with technical, financial, and regulatory complexities. Every revelation, from Jump Trading’s role to the regulatory jurisdiction over digital assets, fuels a multifaceted discourse.

Kwon’s legal defense, built on the premise of currency versus securities, isn’t an isolated stance. It echoes in the halls of crypto exchanges globally, spotlighting the urgent need for clarity in crypto regulatory frameworks.

As the case unfolds, its outcomes could extend beyond Kwon and Terraform Labs. The verdict might influence regulatory norms, investor confidence, and the strategic maneuvers of crypto entities worldwide.

The Broader Narrative – Analyzing Market Dynamics

Jump Trading’s alleged role unveils intricate market dynamics, where market makers, algorithms, and regulatory bodies converge. The interplay, marked by profits and losses, casts a revealing light on the obscured corners of the crypto world.

UST’s 2022 collapse didn’t just echo in financial statements and courtrooms; it rippled across the crypto community. It’s a reminder of the volatile dance between innovation, profit, regulation, and security in the digital asset arena.

While Kwon’s case is a mix of legal, financial, and technical threads, its unraveling might offer more than legal verdicts. It could provide insights, precedents, and reflections, informing the future trajectory of the crypto ecosystem.