The crypto venture capital (VC) funding landscape in 2023 witnessed a substantial decline compared to the previous year. Despite this downturn, the total investment still managed to outpace earlier bear markets, showing resilience in the sector.

Funding Trends in 2023

Crypto VC funding dropped by 68% in 2023, amounting to $10.7 billion, a stark contrast to the $33.3 billion invested in 2022. This decline was influenced by factors like the macroeconomic environment, regulatory uncertainties, and recent setbacks in the crypto industry.

Although 2023’s investment levels fell short of 2022’s heights, they still exceeded the combined investment of $6.4 billion in 2019 and 2020, ranking 2023 as the third-highest year in total crypto VC funding.

Deal Dynamics and Investment Distribution

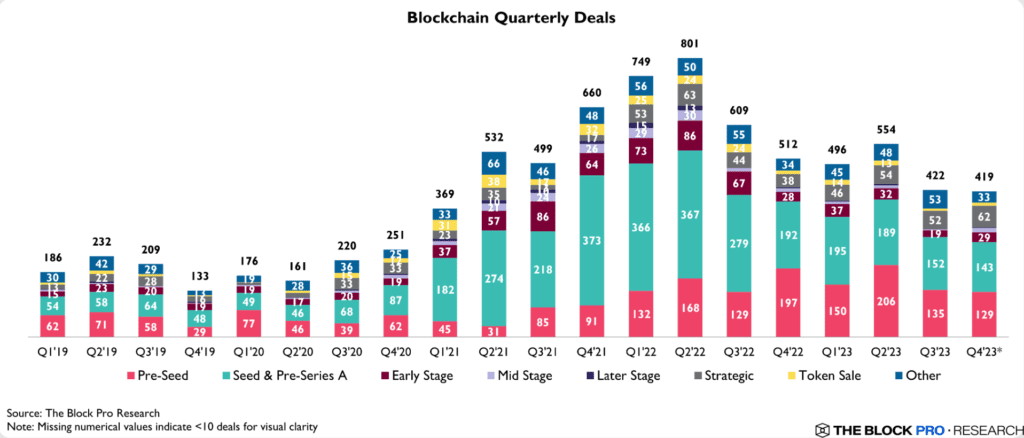

The number of crypto VC deals in 2023 also saw a reduction, with 1,819 deals compared to 2,671 in 2022. However, the deal count remained higher than the monthly averages in 2020 and was close to 2021’s figures.

There was a noticeable shift in investment stages in 2023, with a higher proportion of funding directed towards pre-seed, seed, and pre-Series A startups. In contrast, mid and late-stage startups saw reduced investment activity.

Sectoral Investment Trends

Investment in NFTs and gaming sectors remained robust in 2023. Infrastructure and web3 sectors also attracted significant attention, with a more diversified distribution of funds among various sectors compared to previous years.

Outlook for 2024

Crypto VCs anticipate an upturn in funding and deal count in 2024, aligning with recent positive price shifts and expected bullish trends in the crypto markets. This optimism reflects a belief in the sector’s potential for recovery and growth.

The crypto VC funding landscape in 2023 underwent a period of recalibration, characterized by a significant decrease in overall investment and a shift in the focus of funding stages. Despite these challenges, the resilience of the sector is evident in its ability to outperform previous bear markets. Looking forward, the industry remains optimistic about a potential surge in funding and deals, signaling confidence in the future of crypto ventures.