Coinbase, a leading crypto exchange, isn’t just another player in the crypto market. Recent data indicates a vast treasure trove of Bitcoin under their control. So, what does this mean for the crypto landscape?

Coinbase’s Staggering Bitcoin Assets

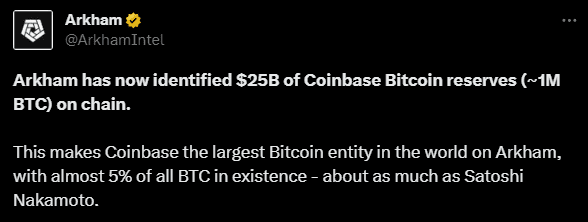

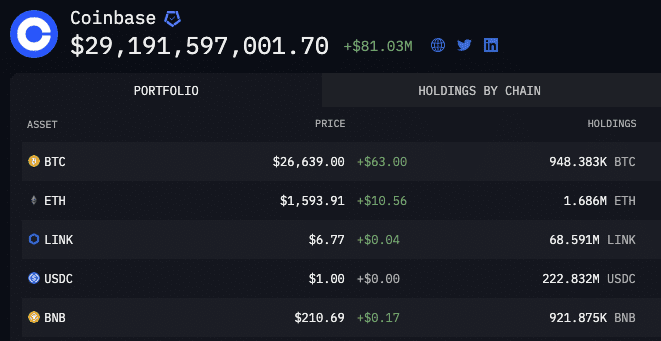

Arkham, a reputable blockchain intelligence platform, recently unraveled a riveting fact: Coinbase is in possession of almost 1 million Bitcoin, equating to an impressive $25 billion based on Bitcoin’s current market rate. But here’s the twist: despite this staggering sum, Coinbase’s personal stash is valued at merely $200 million. The rest? They belong to the users of the platform.

Breaking it down further, this means that Coinbase holds a whopping 5% of all available Bitcoin. With the total circulating supply of Bitcoin being approximately 19,493,537 (as stated by CoinGecko), this revelation highlights the significant influence Coinbase holds within the crypto realm.

The Intricacies Behind the Findings

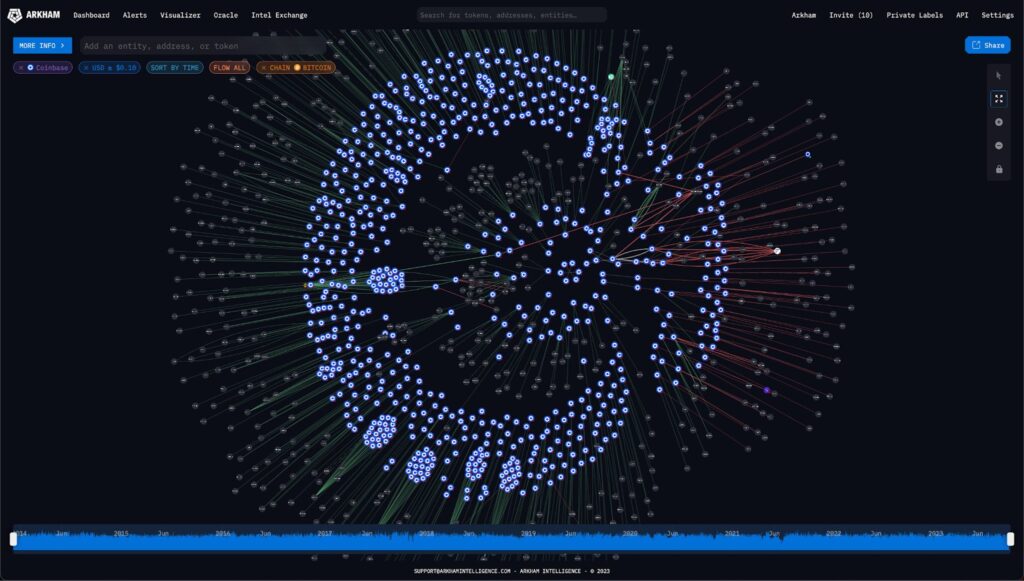

Arkham’s in-depth analysis tagged a remarkable 36 million Bitcoin deposit and holding addresses directly linked to Coinbase. Of these, the largest cold wallet is attributed to holding around 10,000 BTC. But the intrigue doesn’t end there. Arkham’s findings hint at the likelihood of Coinbase having even more undisclosed Bitcoin assets waiting to be unearthed.

The Crypto Community Weighs In

The community’s reaction to Coinbase’s immense Bitcoin holdings has been mixed. While some members see it as a wake-up call to diversify and not centralize their holdings, others feel a tad paralyzed, pondering about the safest avenues to store their digital assets.

The Bigger Ownership Picture

While Coinbase’s assets are significant, let’s not forget other big players. Business intelligence firm MicroStrategy, under the guidance of co-founder Michael Saylor, has declared ownership of 152,800 BTC, an amount surpassing $4 billion.

The Ripple Effect of Coinbase’s Holdings

Coinbase’s mammoth Bitcoin stash reaffirms its influence in the cryptocurrency sphere. With 5% of the world’s Bitcoin under their purview, their strategies and moves could potentially create waves in the market dynamics. As the crypto world continues its intricate dance, all eyes will undoubtedly remain on such influential entities steering the rhythm.