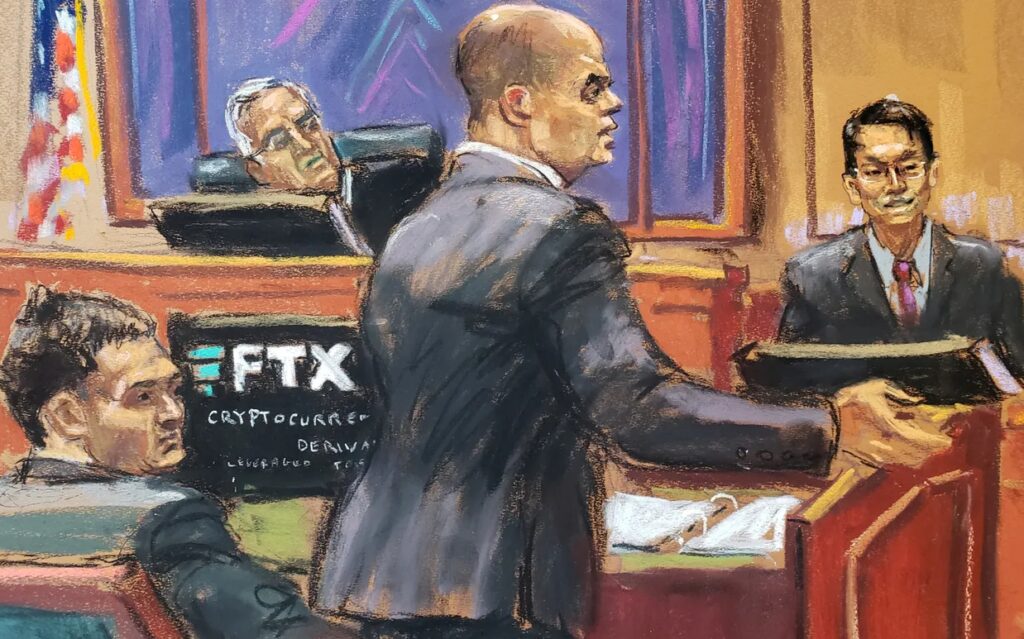

Sam Bankman-Fried (SBF), the renowned FTX founder, finds himself ensnared in legal complexities as the U.S. Department of Justice (DOJ) pushes to limit his defense strategies. Amid the courtroom drama, the discussion around SBF’s significant investment in AI startup Anthropic has been thrust into the limelight.

Anthropic Investment: A Double-Edged Sword?

SBF’s $500 million stake in Anthropic, potentially soaring to a staggering $4 billion amidst new funding opportunities, could be a game-changer. However, the DOJ is adamant about sidelining this investment, emphasizing a narrative focused solely on past actions, not future financial rectifications.

The prosecution’s Oct. 8 letter to Judge Kaplan underscores their unwavering stance. The inclusion of SBF’s Anthropic investment is viewed as a distracting element, likely to derail the trial’s focus. They contend its irrelevance, citing Judge Kaplan’s dismissal of the defense’s intention to use these potential gains as a repayment assurance.

Venture Capital’s Volatile Nature

The prosecution is quick to highlight the erratic nature of venture capital investments. They accentuate FTX’s precipitous valuation decline, painting a picture of instability and uncertainty, undermining the defense’s attempts to portray the Anthropic investment as a bastion of financial restitution.

The Community’s Outlook

The FTX 2.0 Coalition, representing the exchange’s creditors, is watching Anthropic’s financial moves closely. With the AI firm poised for a potential valuation boom, the coalition anticipates a significant uptick in FTX’s stake, fueling prospects of customer compensation.

With legal proceedings against SBF gaining momentum, the defense and prosecution are locked in a meticulous dance. Every evidence piece, every testimony, is scrutinized, dissected, and contested, setting the stage for a trial that could send ripples across the crypto landscape.

The DOJ’s resolute stance to exclude Anthropic’s financial dynamics from the trial underscores the case’s complexity. Amid the legal back-and-forth, the crypto community, investors, and regulatory bodies are closely monitoring developments, each revelation impacting FTX’s narrative and the broader crypto ecosystem.

Unearthing Anthropic’s Potential

Anthropic’s escalating valuation underscores the startup’s burgeoning potential in the AI landscape. As funding pours in and valuation projections soar, SBF’s stake in the firm becomes an increasingly prominent focal point, both a potential boon and a point of contention in the ongoing legal saga.

As the courtroom battle unfolds, the crypto community is on tenterhooks. The verdict, along with decisions on evidence inclusion like the Anthropic investment, will not only shape SBF’s fate but also cast long shadows on the crypto industry’s regulatory landscape and investment dynamics.

The intertwining of legal proceedings and significant investments like that in Anthropic reflects the multifaceted challenges and opportunities defining today’s crypto landscape. Every development, every judicial decision, is a piece of a complex puzzle, shaping the future of crypto innovation, regulation, and investment.